Ensure financial compliance with an EIN

An Employer Identification Number (EIN), also known as a federal tax ID, is mandated by the IRS for filing business taxes, hiring employees, opening a business bank account, and fulfilling compliance obligations. Our online filing system is fast, easy, and secure - $74 + state filing fee.

Frequently asked questions

Why Does My Business Need An Employer Identification Number?

- file business taxes and avoid tax penalties

- hire employees

- prevent identity theft

- establish business credit

What's A Federal Tax Identification Number Or Ein?

this number is generally necessary to pay your employees, open a business bank account, withhold taxes, complete w-9 tax forms as an independent contractor, or pay taxes.

eins are issued by the irs and used on federal tax forms. once your business has been assigned an ein, it never expires and can never be reissued to another business.

How Do I Get An Ein Number?

What Does Having An Ein Number Mean?

Is A Federal Tax Number The Same As A Ssn?

How to get a Tax ID / EIN

All business products

We are committed to

doing right by you.

We support our products and services fully. Find out more about our ComplianceSys

Guarantee.

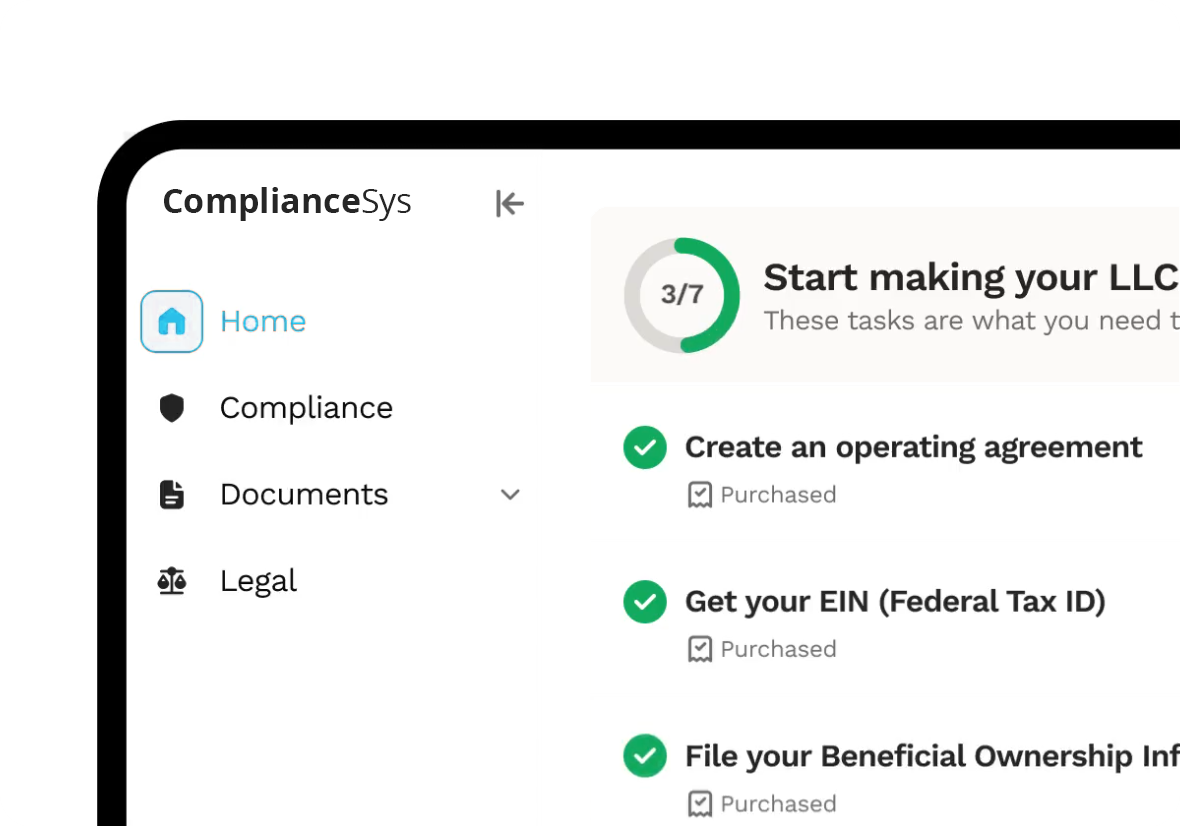

ComplianceSys is a one-stop shop for entrepreneurs

Get access to the complete tools necessary to confidently manage and grow your business.

Our latest articles

What is an LLC

An LLC, or 'limited liability company,' is a business structure that shields business owners from personal liability...

Read more

How to start an LLC

Although the process is relatively straightforward, understanding the seven legally required steps to start an LLC...

Read more

What is an annual report

Most businesses file annual reports with their state to operate legally. For public companies, annual reports...

Read more

Which business type

Choosing a business type in the U.S. involves understanding the different business structures available and selecting...

Read more